5 Best Credit Score Apps to Monitor Your Credit (2024)

Today’s financial world requires you to have a healthy credit score. Your credit score influences everything from loan approvals to interest rates on credit cards. To stay on top of your credit health, credit score monitoring apps have become invaluable tools for individuals seeking financial stability and growth.

These apps for credit check offer real-time updates and in-depth analysis to help you take control of your credit journey. No one wants to be among the 16% of American consumers with very poor credit or a FICO score of between 300 and 579. Because of that, this article covers the best credit score apps that can help you monitor and manage your credit score effectively.

What is the Best Credit Score Monitoring App?

Below are the top picks for credit score apps you need to check out.

1. Credit Karma

Credit Karma is a leading credit score app that has gained immense popularity among individuals seeking to track and manage their credit health. Founded in 2007, Credit Karma has become a trusted platform for over 100 million users in the US, UK, and Canada. This is thanks to its comprehensiveness and user-friendliness.

Credit Karma is able to provide you with free credit scores from two major credit bureaus, Equifax and TransUnion. The credit check costs no money because the platform makes money in other ways, including recommending relevant products and services to shape your finances.

The comprehensive view of your credit standing from Credit Karma enables you to identify areas for improvement and track progress over time. What’s more, Credit Karma serves as a credit monitoring tool that alerts you when significant changes occur regarding your credit report. These changes could be new accounts, credit inquiries, or negative marks.

As if that’s not enough, the app offers valuable insights into the factors that affect your credit score. You can explore credit score breakdowns, see how different actions affect your score, and access personalized tips to improve credit health.

Credit Karama also goes beyond credit scores. It extends its services to give you curated recommendations for credit cards, loans, and other financial products based on your credit profiles.

Key Features

- Credit monitoring app with credit report notifications

- Credit builder that can boost your low credit score

- A financial app that provides you with cards, loans, and more, based on your credit profile

Pricing

The Credit Karma monitoring tool is free to use.

2. Credit Sesame

Another popular credit score app that allows you to access your score daily is Credit Sesame. It was founded in 2010 and now offers a variety of credit-related products and services in one place.

First of all, you can use Credit Sesame’s credit checker for free to know where you stand. The app shows you your credit score from TransUnion credit score which refreshes on a daily basis to keep everything up-to-date.

You also get a summary of your credit report. You’re able to track open accounts, debts, and other aspects of your finances that can impact your credit.

On top of that, Credit Sesame also offers credit monitoring services, providing users with real-time alerts for changes to their credit reports. This includes alerts for new accounts, credit inquiries, or other activities to protect credit and identity.

Key Features

- Credit Score Analysis gives you an in-depth breakdown of your credit scores

- Credit and Loan Marketplace enables you to explore various credit card and loan offers tailored to your creditworthiness and financial goals

- Credit Sesame’s mobile app has a user-friendly interface and easy-to-understand visualizations for conveniently accessing credit information from anywhere

Pricing

While the Credit Sesame app has a free plan, there are paid options for premium users. Credit Sesame Premium is $15.95 a month and offers additional credit bureaus besides TransUnion (Experian and Equifax).

3. Nav

If what you need is a business credit score monitoring platform, Nav is the best choice. This finance app is different from Credit Sesame, which focuses only on personal credit. You’ll need an app like Nav if you’re a business owner looking to get approved for financing options.

If you install Nav on your phone and set up an account, it shows your personal and business credit alongside one another. Nav includes business credit scores from Experian, Equifax, and FICO Small Business Scoring Service (FICO SBSS Score). For personal use, you get Experian and TransUnion credit scores.

You’ll also see which types of financing you have a higher chance of getting. This could be startup funds, credit cards, or a line of credit.

For instance, if it’s business credit cards, you’re able to know which particular company you match well with. The app also displays the introductory and purchase annual percentage rates (APR) before application.

Key Features

- Personal and business credit score app

- Real-time notifications on 90+ types of changes to your personal and business credits

- Personalized financing recommendations based on your credit score

- Bank account data analysis and reports that delve into ways you can make yourself ready to borrow

Pricing

Nav offers free personal and business credit scores.

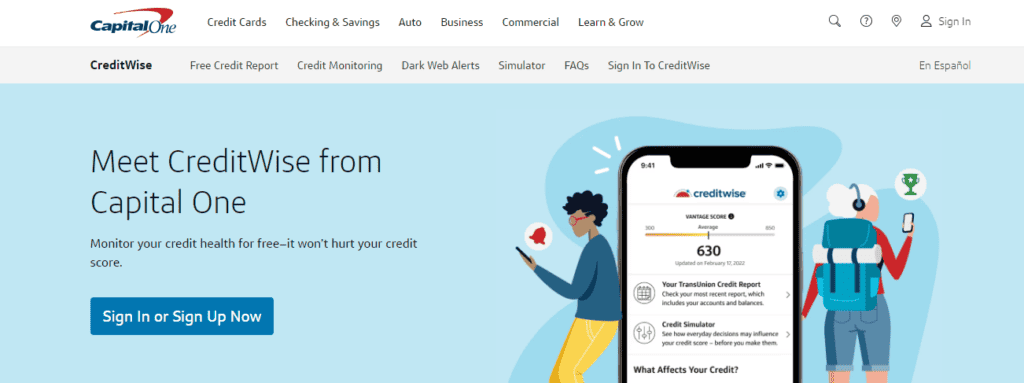

4. CreditWise

CreditWise is a credit score monitoring app offered by Capital One. It’s designed to help users stay informed about their credit standing and make smarter financial decisions. Because of Capital One’s commitment to financial education and empowerment, CreditWise is available for both Capital One customers and non-customers.

CreditWise provides users with free access to their VantageScore® 3.0 credit score from TransUnion. This score is updated regularly and you’ll have a clear and up-to-date view of your credit health. You even get email alerts when your TransUnion credit report changes.

One of the likable things about CreditWise is its free credit score simulator. This tool allows you to experiment with various credit actions to see how they may impact your credit score. For example, you can simulate the effects of paying off a credit card, opening a new account, or increasing credit limits.

What’s even more, CreditWise offers dark web surveillance for you. It monitors the dark web for users’ personal information and alerts you if your data is found in compromised areas.

As part of Capital One’s commitment to financial literacy, you can also find educational resources, articles, and tools to understand credit, improve financial habits, and accomplish financial goals.

Key Features

- Top free VantageScore checker online

- Free credit score simulator

- Free dark web monitoring

Pricing

You can use CreditWise for free.

5. Credit.com

Last on this list of the best credit score apps is Credit.com. The app’s available free credit score is from Experian.

The good thing is that you just need an account to check your credit score. You won’t even have to enter your card details to make any payment. The score is updated every 2 weeks at the moment.

Credit.com also has what’s called a credit report card that explores the 5 factors that can affect your score. These factors are payment history, credit utilization, credit age, new credit inquiries, and account mix. With Credit.com, you also receive a practical action plan to help you hit your credit and financial goals.

Besides checking your score, the app is also great for finding the right cards for you. On the platform, you’ll see cards for bad credit, fair credit, no credit, and students. You can also research cards by type, such as cards with low APR, secured cards, or debit cards.

Credit.com offers loan recommendations too. You’re able to find the most suitable loan type for your needs, such as personal loans, mortgage loans, and auto loans. Besides that, users can access credit repair and personal finance tips.

Key Features

- Credit report card that shows your available credit and more

- Credit card payoff calculator

- A variety of loan calculators

Pricing

It’s free to use Credit.com’s credit report card. But ExtraCredit, the premium option, costs $24.99 a month and includes 28 FICO Scores.

What Is the Most Accurate Credit Score App?

While there are several reputable credit score apps available, some are better than others. The accuracy of credit scores ultimately depends on the data provided by the credit bureaus and the scoring models the app uses.

Some credit score apps may use VantageScore and others utilize FICO score models. This can lead to variations in the credit scores an app provides.

For the most accurate and up-to-date credit scores, you could use credit score services directly from the credit bureaus like Equifax, Experian, or TransUnion. But the thing about credit score apps is that they help you find the right financial products (based on your credit profile) to take your finances to the next level.

How Does a Credit Monitoring App Work?

Credit monitoring apps work in the following way:

- Credit score access: When signing up for a credit monitoring app, you have to fill out some personal information. It includes your name, date of birth, and Social Security number. The app will be able to access your credit information using these details.

- Credit score tracking: A credit score app regularly checks your credit score and credit report from select credit bureaus, such as Equifax, Experian, and TransUnion. It can display your current credit score or show historical credit score data and track how it changes over time.

- Credit alerts: A key feature of credit monitoring apps is the ability to send real-time notifications. These alerts inform you about any significant changes to your credit report, such as new accounts opened in your name, late payments, credit inquiries, or accounts in collections. Timely alerts are great for quickly detecting potential fraud or identity theft.

- Credit factors analysis: Credit monitoring apps often offer insights into the factors affecting your credit score. They may break down the key components for you, such as payment history, credit utilization, and credit mix, among others.

Does Using a Credit Monitoring App Decrease Your Credit Score?

No, using credit monitoring apps doesn’t lower your credit score. This is because these apps use soft inquiries or soft credit pulls to access your credit information. Soft inquiries don’t affect your score and are used solely for monitoring purposes.

Soft inquiries occur when you check your credit score, review your credit report, or when a financial institution checks your credit as part of a pre-approved offer. This is unlike hard inquiries which occur when you apply for new credit (such as a loan or credit card). Soft inquiries don’t affect your creditworthiness or credit score.

So, don’t be afraid to monitor your credit regularly. It doesn’t matter if it’s through credit monitoring apps, credit bureaus, or financial institutions.

Wrapping It up

Hope you now have an idea of which is the best credit score app for your needs. It all depends on whether you need one for personal or business needs. Also, you could consider things like the app’s access to a specific credit card bureau.

So, pick an app and begin your credit-building journey today. Feel free to go with two or more apps for comparison purposes and see which ones you like more.